Incorporating sustainability into your monetary technique isn’t simply a pattern however a elementary shift in how companies function and thrive in an increasingly more environmentally aware international. This means emphasizes the mixing of sustainable practices into monetary making plans, funding choices, and general company governance, reflecting a rising popularity of the interdependence between monetary efficiency and ecological duty.

As organizations face mounting pressures from stakeholders and regulatory our bodies to undertake sustainable practices, the need of aligning monetary methods with environmental, social, and governance (ESG) standards turns into glaring. By way of doing so, firms can beef up their popularity, mitigate dangers, and unencumber new alternatives, in the end resulting in long-term resilience and profitability.

In an generation the place environmental considerations are at the leading edge of worldwide dialog, the mixing of sustainability into monetary methods has emerged as a pivotal pattern. This means now not handiest complements company duty but in addition aligns monetary objectives with the imperatives of environmental stewardship. Working out the right way to weave sustainable practices into your monetary framework is very important for people and companies alike. This newsletter delves into the nuances of constructing a sustainable monetary technique, addressing commonplace misconceptions, and providing transparent, actionable steps to make it a truth.

Working out Sustainability in Monetary Context

Sustainability, in a monetary context, refers back to the observe of creating funding and monetary choices that believe environmental, social, and governance (ESG) elements. It transcends mere profitability, aiming for a steadiness between financial luck and ecological preservation. Many of us mistakenly consider that adopting sustainable practices involves vital sacrifices in monetary returns. Alternatively, analysis signifies that sustainable investments ceaselessly yield aggressive, if now not awesome, returns over the years. This review lays the groundwork for a extra profound figuring out of the way sustainability can beef up your monetary technique.

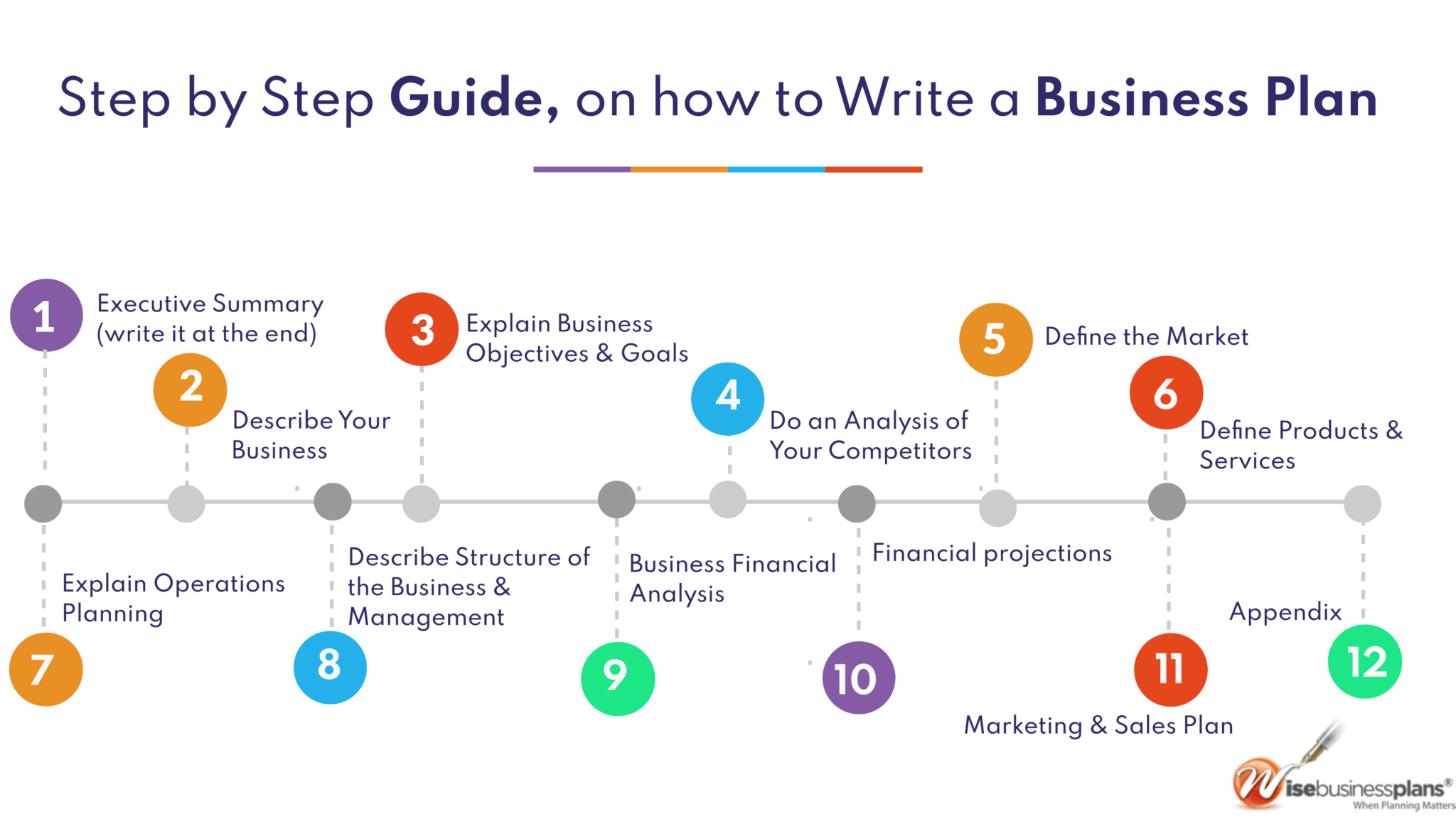

Step-by-Step Information to Incorporating Sustainability: Incorporating Sustainability Into Your Monetary Technique

1. Assess Your Present Monetary Practices

Step one on your sustainability adventure is to habits a radical evaluate of your present monetary practices. This contains figuring out the place your cash is recently invested, comparing the sustainability of the ones investments, and figuring out spaces for growth. Believe the next questions:

- What industries do my investments fortify?

- How do those industries affect the surroundings?

- Do the corporations I spend money on prioritize sustainability?

2. Set Transparent Sustainable Monetary Objectives

After you have evaluated your present standings, it is necessary to determine transparent, measurable objectives that align with sustainability. Those objectives must be particular (e.g., scale back carbon footprint by means of X% inside of Y years), actionable, and time-bound. Atmosphere those objectives will assist information your monetary choices and investments. It is usually very important to be in contact those objectives to stakeholders, making sure that everybody concerned understands and helps the sustainability imaginative and prescient.

3. Analysis Sustainable Funding Alternatives

Along with your objectives in position, your next step comes to exploring funding alternatives that align along with your sustainability targets. This will come with:

- Renewable power resources

- Inexperienced bonds

- Sustainable mutual price range

- Firms with sturdy ESG rankings

Using assets like Wikipedia or accomplishing a Google seek may give insights into best entities focusing on sustainable investments.

4. Put in force a Tracking Gadget

To make sure that your sustainable monetary technique stays efficient, it’s important to determine a tracking machine. This comes to ceaselessly reviewing your investments and monetary practices to evaluate development towards your sustainability objectives. Gear corresponding to monetary dashboards can assist observe your efficiency, whilst periodic critiques will show you how to make important changes. Believe the next metrics for tracking:

- Carbon emissions discounts

- Social affect tests

- Monetary efficiency in opposition to sustainable benchmarks

5. Have interaction With Stakeholders, Incorporating sustainability into your monetary technique

Engagement with stakeholders, together with workers, consumers, and traders, is paramount on this adventure. By way of fostering a tradition of sustainability inside of your company, you’ll be able to beef up consciousness and inspire others to apply go well with. Sharing your sustainability achievements and demanding situations now not handiest builds believe but in addition conjures up collective motion. Common conversation thru newsletters, social media, or corporate conferences can stay the momentum going.

6. Keep Knowledgeable and Adapt

The panorama of sustainability is continuously evolving with new applied sciences, laws, and marketplace dynamics. Staying knowledgeable about those adjustments will permit you to adapt your monetary technique accordingly. Take part in workshops, attend related meetings, and subscribe to sustainability-focused publications to stay your wisdom up-to-date. This steady finding out means will place you as a pace-setter in sustainable finance.

Not unusual Misconceptions About Sustainable Finance

As you embark in this adventure, it is very important to deal with some commonplace misconceptions that can obstruct your development:

- Fantasy 1: Sustainable making an investment is just for rich people.

- Fantasy 2: Sustainable investments yield decrease returns.

- Fantasy 3: Sustainability is simply too complicated to combine into finance.

By way of debunking those myths, you’ll be able to empower your self and others to include sustainability as a core part of monetary technique.

Additional information about how FinTech is changing business finance is on the market to supply you further insights.

Conclusion: The Trail Ahead

Incorporating sustainability into your monetary technique isn’t simply an choice however a need in as of late’s international. By way of following the Artikeld steps, you’ll be able to create a strong and sustainable monetary plan that aligns with international objectives whilst bettering your monetary efficiency. Keep in mind, the transition calls for dedication, finding out, and adaptation. Get started small, keep knowledgeable, and step by step combine sustainability into each and every aspect of your monetary technique.

As you progress ahead, believe taking motion as of late by means of reassessing your investments and committing to sustainable practices. The way forward for finance lies in sustainability, and by means of being proactive, you’ll be able to give a contribution to a extra sustainable international whilst securing your monetary long run.

*Post Disclaimer*

The information Article Incorporating Sustainability Into Your Financial Strategy no representations or warranties of any kind suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

PT Terbuka is not responsible for user-generated content. We disclaim all liability for posts violating any laws or ethical standards. Users alone bear full responsibility for their submissions. Violations will result in immediate content removal and account restriction without appeal.